31+ reverse mortgage qualification

HOA fees if applicable will. Web Age Requirement.

What Are Qualifications For A Reverse Mortgage Purchase Loan

Because HECMs are insured through the Federal Housing Administration FHA and overseen by the US.

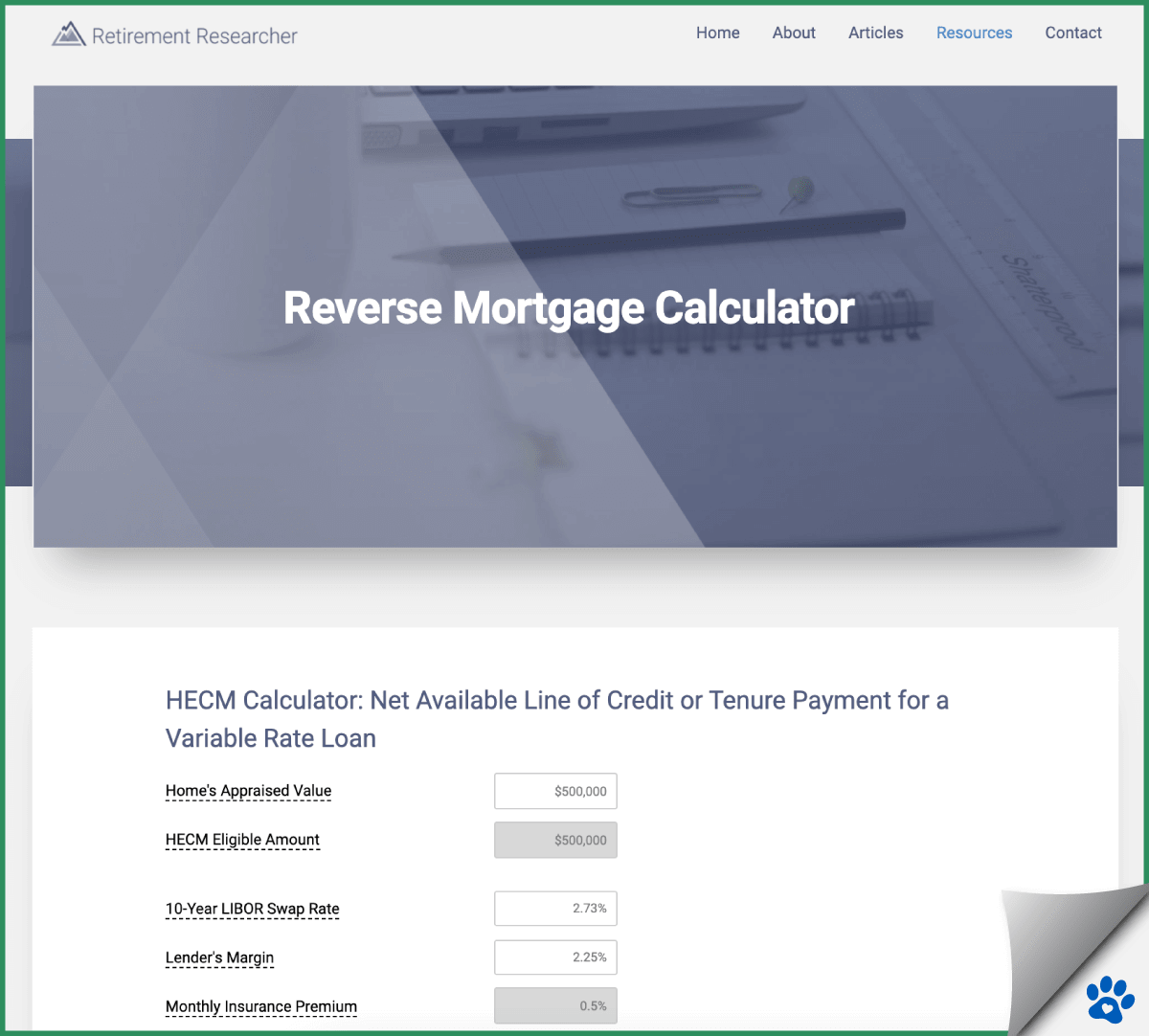

. Web Reverse mortgage eligibility requires that you are at least 62 years old and own a significant amount of equity in your home. Instantly estimate your reverse mortgage loan amount with the Reverse Mortgage Calculator. Web Reverse Mortgage Qualifications Requirements.

The youngest borrower on title must be at least 62 years old live in the home as their primary. Compare Pros Cons of Reverse Mortgages. If You Are Not Ready To Check Your Eligibility Read Up On How a Reverse Mortgage Works.

Get Instantly Matched With Your Ideal Mortgage Lender. Reverse borrowers need to own. Neither income nor credit history is considered by lenders in determining.

Get A Free Information Kit. Learn More See If You Qualify. Web Based on the table if you have an annual income of 68000 you can purchase a house worth 305193.

Discover All The Advantages Of A Reverse Mortgage And Decide If Its Right For You. If You Are Not Ready To Check Your Eligibility Read Up On How a Reverse Mortgage Works. Web Most owner-occupied homes are eligible for a reverse mortgage including single-family homes two- to four-unit homes townhomes and FHA-approved condos.

Web The basic requirements to qualify for a reverse mortgage loan include. For Homeowners Age 61. Web Reverse mortgage borrowers and any co-borrowers must be at least 62 years old to qualify.

Web Qualify For Reverse Mortgage Reverse mortgages are available to homeowners 62 years old or older. Try Our Free Calculator To Receive a General Estimate If You Are Eligible. Web If youre 62 or older you might qualify for a reverse mortgage.

Web To qualify for an HECMthe most common reverse mortgageyou must. If you or your. Ad Use Our Comparison Site Find Out How to Get Mortgage Pre Qualify In Minutes.

Web To qualify for a reverse mortgage homeowners must be able to pay their own property taxes homeowners insurance and home maintenance. Web Reverse mortgage transaction has the meaning set forth in 12 CFR 102633a. Web The US.

In general to be eligible for a reverse mortgage the youngest borrower on title must be 62 years old or older and have sufficient home equity. Ad Compare the Best Reverse Mortgage Lenders. Compare Now Find The Lowest Rate.

Ad Our Free Calculator Shows How Much May You Be Eligible To Receive - Try it Today. Since reverse mortgages are for seniors at least one of the borrowers must be 62 or older to qualify for the HECM program. Ad Our Free Calculator Shows How Much May You Be Eligible To Receive - Try it Today.

The property must be either 1-4 unit primary residences condominiums or manufactured homes that meet FHAs. Ad While there are numerous benefits to the product there are some drawbacks. Web Borrowers must be at least sixty-two years of age or older.

You may qualify for a loan amount of 252720 and your total monthly. Here are the basic requirements. Service provider means any party retained by a servicer that interacts with a borrower or provides.

Be at least 62 years old Own your property outright or have at least 50 equity in it Live. Department of Housing and Urban Development HUD has again delayed the end of the review period of the draft Home Equity Conversion Mortgage. Ad If Youre 62 Or Older A Reverse Mortgage Loan May Be Right For You.

Ad How Does A Reverse Mortgage Work. With a reverse mortgage the amount of money you can borrow is based on how much equity you have in your. Web A reverse mortgage is a type of mortgage loan that is generally available to homeowners 60 years of age or older that permits you to convert some of the equity in your home into.

For Homeowners Age 61. Ad Free Reverse Mortgage Information. Web Eligible property types for a HECM reverse mortgage include Single Family Residences SFR Town Houses Planned Unit Developments PUD and some manufactured.

Reverse Mortgage Qualifications Eligibility Goodlife

Reverse Mortgage Credit Requirements Just Ask Arlo

Reverse Mortgage Eligibility Requirements

Reverse Mortgage Home Loans Cs Bank Northwest Arkansas Cassville Mo

Reverse Mortgage Qualifications Eligibility Goodlife

Reverse Mortgage For Purchase Access Reverse Mortgage

Eligibility Requirements For Reverse Mortgage Rmf

Reverse Mortgage Requirements Hecm Single Purpose Jumbo Loans Moneygeek Com

Reverse Mortgage Guides Mls Reverse Mortgage Powered By Zyng Mortgage

Reverse Mortgage Property Requirements Updated 2023

Eligibility Requirements For Reverse Mortgage Rmf

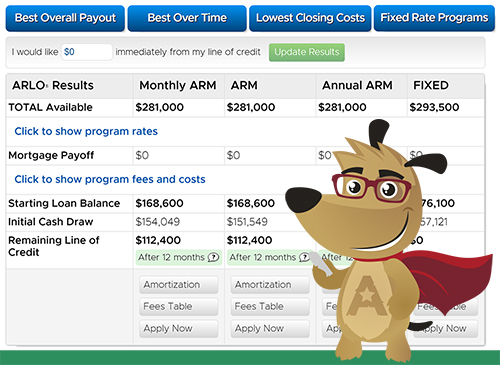

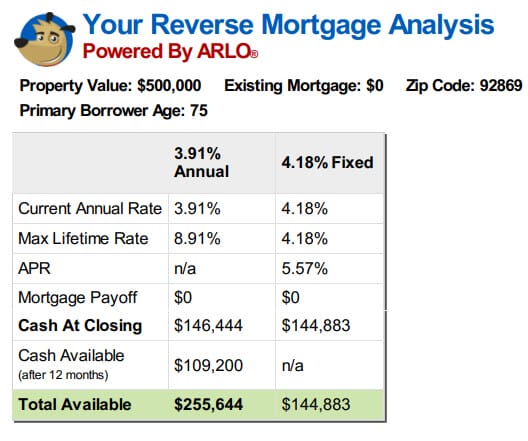

Top 3 Reverse Mortgage Calculators In 2023 No Personal Info

How To Get Out Of A Reverse Mortgage Lendingtree

Eligibility Requirements For Reverse Mortgage Rmf

Here Are The Income Requirements For A Reverse Mortgage

Here Are The Income Requirements For A Reverse Mortgage

Here Are 3 Reverse Mortgage Examples In 2023